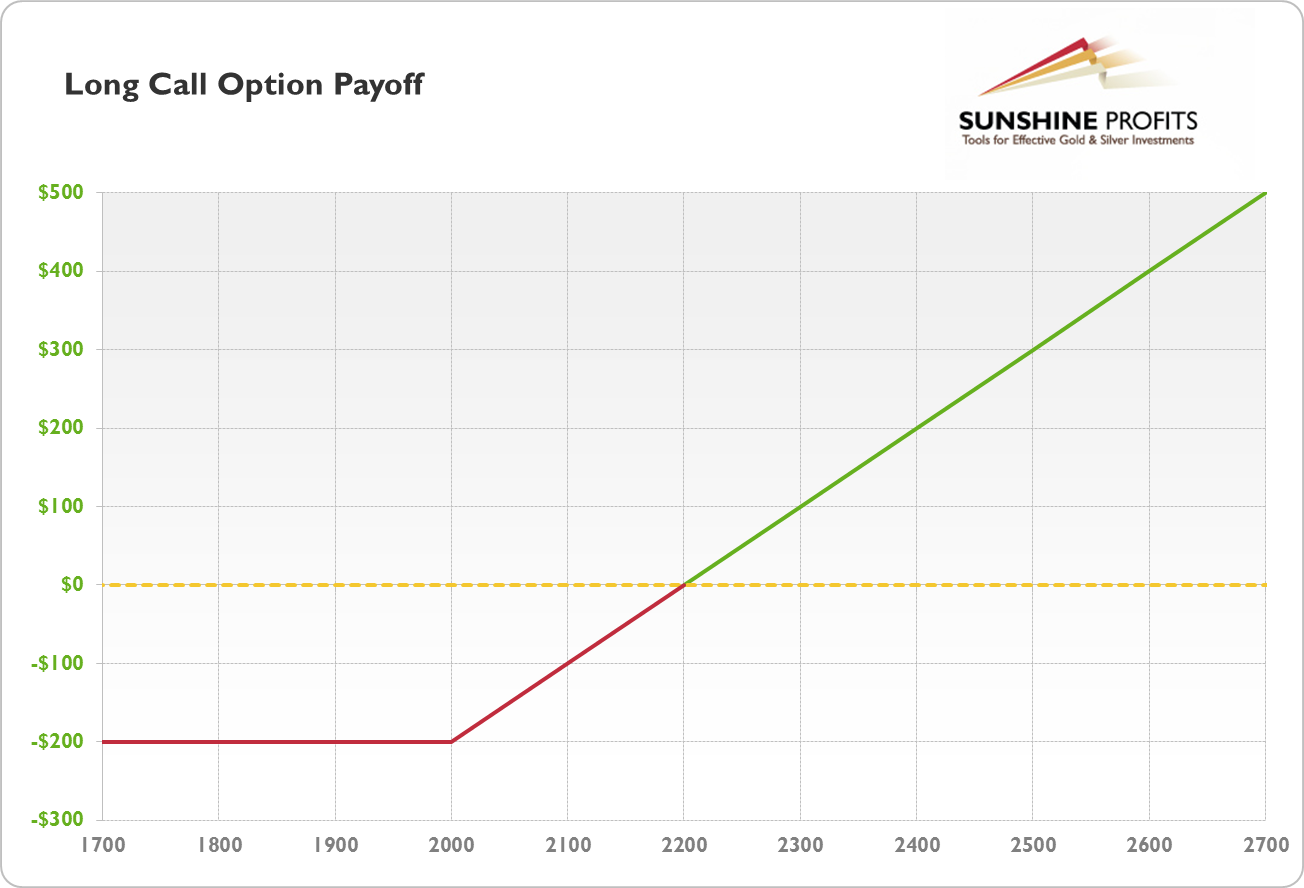

Payoff of long call option

A profit and loss diagram, or risk graph , is a visual representation of the possible profit and loss of an option strategy at a given point in time. Option traders use profit and loss diagrams to evaluate how a strategy may perform over a range of prices, thereby gaining an understanding of potential outcomes. Because of the visual nature of a diagram, traders can evaluate the potential profit and loss, and the risk and reward of the position, at a glance. To create a profit and loss diagram, values are plotted along the X and Y axes.

The horizontal axis the x-axis shows the underlying prices, labeled in order with lower prices on the left and higher prices towards the right. The current underlying price is usually centered along this axis.

The vertical axis the y-axis represents the potential profit and loss values for the position. The breakeven point that indicates no profit and no loss is usually centered on the y-axis, with profits shown above this point higher along the y-axis and losses below this point lower on the axis.

Figure 8 shows the basic structure of a profit and loss diagram. The blue line below represents the potential profit and loss across the range of underlying prices. For simplicity, we'll begin by taking a look at a long stock position of shares. The diagram in Figure 9 shows the potential profit and loss for this position. As the stock price moves higher, so does the profit; conversely, as the price moves lower, the losses increase.

Since there is, in theory, no upper limit to the stock's price, the graph line shows an arrow on one end.

Call Option Payoff - Finance Train

With options, the diagram looks a bit different since your downside risk is limited to the premium you paid for the option. It should be noted that the above example shows a typical graph for a long call; each option strategy - such as long call butterflies and short straddles - has a "signature" profit and loss diagram that characterizes the profit and loss potential for that particular strategy.

Figure 11, taken from the Options Industry Council 's website, shows various options strategies and their corresponding profit and loss diagrams. Most options trading platforms and analysis software let you create profit and loss diagrams for specific options. In addition, the charts can be created by hand, by using spreadsheet software such as Microsoft Excel, or by purchasing commercially available analysis tools. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Profit And Loss Diagrams By Jean Folger Share. A Review Of Basic Terms Options Pricing: The Basics Of Pricing Options Pricing: Intrinsic Value And Time Value Options Pricing: Factors That Influence Option Price Options Pricing: Distinguishing Between Option Premiums And Theoretical Value Options Pricing: Black-Scholes Model Options Pricing: Cox-Rubinstein Binomial Option Pricing Model Options Pricing: Profit And Loss Diagrams Options Pricing: The Greeks Options Pricing: The basic structure of a profit and loss diagram.

Any value plotted above the x-axis would represent a gain; any value plotted below would indicate a loss. A profit and loss diagram for a hypothetical stock this does not factor in any commissions or brokerage fees.

A profit and loss diagram for a long option position. Various profit and loss diagrams for different options strategies. Image is from the Options Industry Council website. With a single diagram, you can see how price, time and volatility affect potential gains. Learn the top three risks and how they can affect you on either side of an options trade.

You can make money on a falling stock. Find out how going long on a put can lead to profits.

Long Call Explained | Online Option Trading Guide

Shorting covered calls is a popular options trade strategy. Options offer alternative strategies for investors to profit from trading underlying securities, provided the beginner understands the pros and cons. Learn more about stock options, including some basic terminology and the source of profits. We explain the risks, rewards, timing, and profit and loss considerations for covered calls with dividend stocks. Strip Options are market neutral trading strategies with profit potential on either side price movement, with a "bearish" skew.

Call Option Payoff Diagram, Formula and Logic - Macroption

Here are the different criteria to ensure maximum profit taking while trading options. You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.