Tax rate for incentive stock options

Introduction To Incentive Stock Options

For established landowners, helping a new farmer or rancher can take many forms and offer a variety of monetary, social, and personal rewards. In Nebraska there are two specific tax incentive programs to motivate farm and ranch owners to provide an opportunity to a beginning farmer or rancher.

These two programs can be used in succession with one another to provide maximum benefit to the farm or ranch owner.

The Beginning Farmer Tax Credit Program provides a direct credit from the State of Nebraska a similar program is also available in Iowa to individuals who rent agricultural assets land, facilities, breeding stock, and equipment to a new farmer.

The new farmer must also be a legal resident, demonstrate adequate farming or livestock production experience, and provide a majority of the day-to-day physical labor and management of the operation. Corn is raised on the land, yielding bushels per acre.

How Incentive Stock Options are Taxed

Total crop amounts to 54, bushels. The owner's share of the crop is 27, bushels. This program can be used prior to using the Aggie bond program offered by the Nebraska Investment Finance Authority described below. If you are already renting to tennessee cattle auctions beginning farmertax rate for incentive stock options encourage you to consider this program.

The approval board meets quarterly to approve all applications. You can modify any current lease arrangements for approval by the board within your tax year and qualify for the credit now. For more informationclick here. Or contact Karla Bahm, NextGen, Nebraska Department of Agriculture, PO Boxkarla.

What is INCENTIVE STOCK OPTION? What does INCENTIVE STOCK OPTION mean?You can also call NextGen at Lakers trade rumors 2016 beasley a Tax-exempt Loan Once a qualified borrower finds tax rate for incentive stock options lender, interest income on the loan is tax-exempt to the lender both federally and Nebraska statethus enabling the lender to offer the borrower a reduced interest rate.

For more information, visit the NIFA websitecontact Dudley Beyer at NIFA, or call NIFA at To read more on retirement options, estate planning and tax considerations, click here.

Interested in tax incentives in Iowa? If you are seriously considering helping a beginning farmer or working with an existing farmer or land owner and would like to discuss your circumstances to offer a winning situation for all parties involved, please contact the Center for Rural Affairs.

An initial consultation is free and in-depth strategy sessions can be arranged on a fee basis.

Contact Wyatt Fraas, wyattf cfra. Skip to main content. Search Search form Search.

Stock Options and the Alternative Minimum Tax (AMT)

Financial Overview New Farmer Finance Tax Incentives Farm and Business Transitions. Tax Incentive Programs for Working with Beginning Farmers or Ranchers in Nebraska.

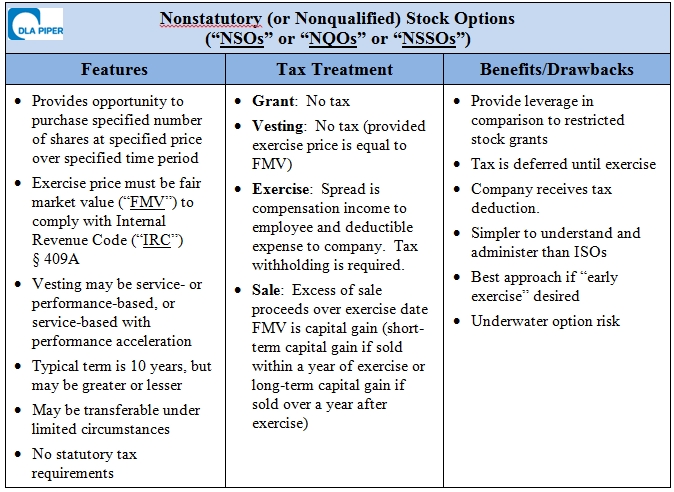

Incentive Stock Options vs. Nonqualified Stock Options - A General Summary - Lexology

Beginning Farmer Tax Credit Nebraska Investment Finance Authority NIFA Aggie Bond These two programs can be used in succession with one another to provide maximum benefit to the farm or ranch owner. The tax credit incentives to landowners: NIFA loan proceeds may only be used for an agricultural purpose in Nebraska.

Acre size limits are based on census data, are periodically updated, and are listed in the NIFA program information. Substantial farmland refers purely to land used for an agricultural purpose.

The value of a homestead on an acreage, for example, is not held against the borrower in comparing to previous ownership limits. Contact Us Privacy Public Disclosure RSS Feeds Login.

Open Source Powered by Drupal Site by CivicActions.