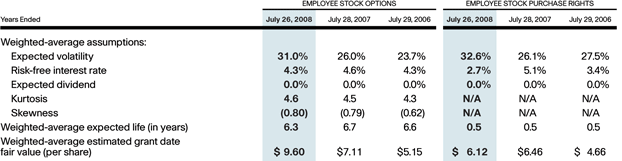

Weighted-average fair value of stock options

The estimated dividend rate a percentage of the share price to be paid expected dividends to holders of the underlying shares over the option's term.

The weighted average fair value of all of the options granted during the periods indicated have been estimated using the Black-Scholes option-pricing model with the following assumptions : for Provident_Bankshares (PBKS)

The estimated measure of the percentage by which a share price is expected to fluctuate during a period. Volatility also may be defined as a probability-weighted measure of the dispersion of returns about the mean.

Hughes Optioneering

The volatility of a share price is the standard deviation of the continuously compounded rates of return on the share over a specified period. That is the same as the standard deviation of the differences in the natural logarithms of the stock prices plus dividends, if any, over the period.

Calculation of Fair Value of Stock Options for Charlotte_Russe_Holding (CHIC)

Line items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

Weighted average per share amount at which grantees can acquire shares of common stock by exercise of options. Expected term of share-based compensation awards, in 'PnYnMnDTnHnMnS' format, for example, 'P1Y5M13D' represents the reported fact of one year, five months, and thirteen days.

Quarterly report pursuant to Section 13 or 15 d Cover Document and Entity Information Financial Statements Unaudited Condensed Consolidated Balance Sheets Unaudited Condensed Consolidated Balance Sheets Parenthetical Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss Unaudited Condensed Consolidated Statements of Shareholders' Equity Deficit Unaudited Condensed Consolidated Statements of Cash Flows Notes to Financial Statements Description of Business and Basis of Presentation Basis of Presentation and Significant Accounting Policies Business Combinations Long-Term Obligations Contingent Consideration Income Taxes Goodwill and Intangible Assets Notes Common Stock Stock-Based Compensation Related Party Transactions Employee Benefit Plans Commitments and Contingencies Notes Loss per Share Notes Accounting Policies Summary of Significant Accounting Policies Policies Notes Tables Business Combinations Tables Long-Term Obligations Tables Contingent Consideration Tables Goodwill and Intangible Assets Tables Stock-Based Compensation Tables Loss per Share Tables Notes Details Description of Business and Basis of Presentation - Additional Information Detail Summary of Significant Accounting Policies - Additional Information Detail Basis of Presentation and Significant Accounting Policies - Schedule of Estimated Useful Lives Detail Basis of Presentation and Significant Accounting Policies - Calculations of Earnings Loss Per Share Detail Basis of Presentation and Significant Accounting Policies Goodwill Rollforward Details Estimated Calculation of Total Combination Consideration Detail Estimated Calculation of Total Combination Consideration Footnote Detail Uncategorized Business Combinations Schedule of Fair Values of Asset Acquired and Liabilities Assumed Business Combinations Gross Intangible Assets Acquired Details Schedule of Pro Forma Results of Operations Detail Schedule of Preliminary Amounts Recognized as of Acquisition Date for Each Major Class of Assets Acquired and Liabilities Assumed Description of Estimates or Ranges of Inputs Non-printing Detail Schedule of Preliminary Amounts Recognized as of Acquisition Date for Each Major Class of Assets Acquired and Liabilities Assumed Footnote Detail Schedule of Preliminary Amounts Recognized as of Acquisition Date for Each Major Class of Assets Acquired and Liabilities Assumed Detail Long-Term Obligations - Additional Information Detail Schedule of Long-Term Obligations Detail Long-Term Obligations Schedule of Future Minimum Repayment Details Contingent Consideration Contingent Consideration Liability Rollforward Details Contingent Consideration Additional Information Details Income Taxes - Additional Information Detail Income Taxes - Reconciliation of Unrecognized Tax Benefits Details Goodwill and Intangible Assets Details Goodwill and Intangible Assets Schedule of Goodwill Rollforward Details Goodwill and Intangible Assets Effect of One Percentage Change in Input Details Common Stock - Additional Information Detail Stock-Based Compensation - Stock-Based Compensation - Additional Information Detail Stock-Based Compensation - Assumptions of Weighted Average Fair Value of Stock Options Granted Detail Stock-Based Compensation - Summary of Stock Option Activity Detail Stock-Based Compensation - Share-Based Compensation Costs Details Stock-Based Compensation - Restricted Stock Unit Activity Details Related Party Transactions - Additional Information Detail Commitments and Contingencies Details Loss per Share Details Uncategorized Items - fenx Stock-Based Compensation - Assumptions of Weighted Average Fair Value of Stock Options Granted Detail v3.

X - Definition The estimated dividend rate a percentage of the share price to be paid expected dividends to holders of the underlying shares over the option's term. Share-based Compensation Arrangement by Share-based Payment Award [Line Items].

Weighted average exercise price, shares granted USD per share. May 13, Management Grant [Member].

Maximum [Member] May 13, Management Grant [Member]. Expected life of option.