Forex momentum divergence indicator

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used.

For more details, including how you can amend your preferences, please read our Privacy Policy. One of the key concepts in technical analysis is the idea of trend. Many strategies rely on identifying whether the market is in a trend or not — and from there, working out if a trend is beginning or coming to an end. Knowing whether a trend is starting up or just about to break down is an extremely useful piece of information to have at your disposal.

Part of knowing whether a trend will continue comes down to judging just how much gusto lies behind the move. This strength behind the trend is often referred to as momentum , and there are a number of indicators that attempt to measure it. Some of the better-known momentum indicators are Relative Strength Index RSI , Stochastic and Moving Average Convergence Divergence MACD.

You can read more about MACD in our list of the most important Forex indicators. RSI and Stochastic are both oscillators, meaning their values move between a bounded range often between 0 and This article is going to discuss another momentum oscillator that some argue is just as effective as its more famous counterparts. This is the momentum indicator , which plots a curve that oscillates either side of a centreline value of , as we shall see.

Like RSI and Stochastic, the momentum indicator can help to identify when a market move is overbought or oversold. That is, to show whether enough momentum remains behind a trend to keep the price-move going. When a falling market is oversold, it may be about to bounce.

When a rising market is overbought, it may be about to fall. The momentum indicator comes as one of the standard indicators that are available as part of the default version of MT4. The calculation behind the momentum indicator is fairly straightforward.

The indicator works by making a comparison between a certain price and the price a set number of periods before that. The first step is to choose a value for N , the number of periods that will be used for the comparison. The momentum MT4 default value for N is 14, but you can set it to whatever value you see fit to use. So our two comparison prices are the closing price of the current bar and the closing price N bars ago.

The formula for momentum is then as follows:. The good news is that MT4 does the calculations all for you in an instant and displays it for you in a supplementary chart below your main chart. The peaks and troughs of this line reflect key shifts in the momentum of the Forex rate. You can see that over the course of our chart, the momentum indicator varies from about The further above , the faster the price is moving upwards.

The further below , the faster the price is moving down. As we said before, the momentum indicator is one of several trend-gauging oscillators available with MT4. You also have access to RSI and Stochastic.

As a sidenote, there are other momentum indicators out there, such as the MT4 Stochastic Momentum Index SMI , but you will have to download these as custom indicators if you are interested. You can use the momentum indicator to provide trading signals directly, but it is more commonly used as a confirmation tool. The simplest signal is to take any cross across the centreline as a signal, buying when the value rises from beneath to above and selling when it drops below from above.

This is a rudimentary approach, though, and should be considered with great caution. The timing of such signals can be tardy, meaning you miss most of the move by the time the signal arrives.

The timing can, however, be improved with the use of a moving average in conjunction with the momentum indicator. Some traders like to smooth the momentum curve using a simple moving average SMA. You can do this by clicking on Moving Average in the selection of Trend indicators in MT4's navigator and dragging and dropping it into your Momentum Indicator chart. This will bring up a typical dialogue box. In the Parameters section choose First Indicator's Data from the Apply to dropdown menu as shown below:.

The trading strategy now becomes to buy when the momentum line crosses above the SMA and sell when it crosses below the SMA. This should improve the timing of the signal slightly, but still has the drawback of offering many false signals.

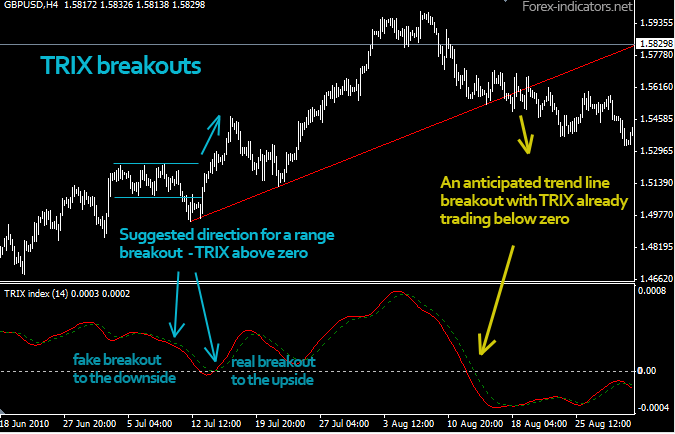

The indicator really comes into its own when used as a means of confirming signals from a separate, primary indicator. One of the best momentum indicator methods is to look for divergence between price and momentum as a way of measuring the strength behind a move.

Momentum Indicator MT4 - All you need to know

So your buy or sell signal would come from whatever you have chosen as your primary indicator. Bullish divergence suggests an oversold market.

If the price falls to new lows but the momentum indicator fails to make new lows, this is a bullish divergence. Bearish divergence suggests an overbought market. If the price rises to new highs but momentum fails to make a new high, this is a bearish divergence. You would only follow a buy signal from your primary indicator when confirmed by bullish divergence from your momentum indicator. Similarly, you would only follow a sell signal when confirmed by bearish divergence.

It's often useful to combine dissimilar indicators in this way, so that the differing aspects in their methods complement each other.

Another example of this is combining momentum with volatility measures to form a squeeze momentum indicator. Bollinger Bands provide a guide to volatility, widening in times of high volatility and narrowing when volatility is low.

A Bollinger band squeeze is when volatility narrows to a historically low level. Such periods are likely to be followed by a significant move, or so the theory suggests. The direction of the breakout is not indicated by the Bollinger bands indicator, though.

A squeeze momentum strategy would use momentum as the means for gauging the direction. If you're interested in expanding the number of indicators you see in MT4, you should check out MetaTrader 4 Supreme Edition. It's a free plugin for MT4, with a selection of extra tools and indicators that have been chosen and developed by our in-house experts. As we have seen, the momentum indicator is a useful tool with a broad range of applications.

The same tool can be used as a stock's momentum indicator and as a Forex momentum indicator. The versatility of the indicator also means you can easily create momentum trading systems that work in the short-term as well as the long. As a general rule for the momentum indicator, the shorter the timeframe used, the more sensitive the performance.

This comes with the catch that it is likely to generate more false signals than a longer time frame. Its broad applicability means the momentum indicator could be the tool for you, whether you're a day trader or position player. Of course, as we discussed in the first part of the article, the momentum indicator is not the only way of measuring the strength of the trend.

There are plenty of other momentum indicators out there. So if you want to determine which is the best momentum indicator for day trading or long-term trading, what can you do? The smart way is to use our demo trading account and decide for yourself which is the best momentum indicator in MT4.

Rather than taking someone else's word for it, you'll know for sure what works best for you. Trading foreign exchange or contracts for differences on margin carries a high level of risk, and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment.

Therefore, you should not invest or risk money that you cannot afford to lose. You should ensure you understand all of the risks. Before using Admiral Markets UK Ltd services please acknowledge the risks associated with trading. The content of this Website must not be construed as personal advice. Admiral Markets UK Ltd recommends you seek advice from an independent financial advisor. Admiral Markets UK Ltd is fully owned by Admiral Markets Group AS. Admiral Markets Group AS is a holding company and its assets are a controlling equity interest in Admiral Markets AS and its subsidiaries, Admiral Markets UK Ltd and Admiral Markets Pty.

All references on this site to 'Admiral Markets' refer to Admiral Markets UK Ltd and subsidiaries of Admiral Markets Group AS. Admiral Markets UK Ltd. Clare Street, London EC3N 1LQ, UK. About Us Why Us? Regulatory Authorisation Admiral Markets UK Ltd is regulated by the Financial Conduct Authority in UK.

Contact Us Leave feedback, ask questions, drop by our office or simply call us. Partnership Enhance your profitability with Admiral Markets - your trusted and preferred trading partner. Careers We are always on the lookout to add new talent to our international team. Press Centre Get the latest Admiral Markets press releases and find our media contacts in one place, whenever you want them Order execution quality Read about our technologies and see our monthly execution quality report.

Account Types Choose an account that suits you best and start trading today. Top products Forex Commodities Indices Shares Bonds. Contract Specifications Margin requirements Volatility Protection. Learn more about this plugin and its innovative features. MT4 WebTrader Use MT4 web trading with any computer or browser no download necessary.

Fundamental Analysis Economic events influence the market in many ways. Find out how upcoming events are likely to impact your positions. Technical Analysis Charts may show the trend, but analysis of indicators and patterns by experts forecast them.

See what the statistics say.

Forex Calendar This tool helps traders keep track of important financial announcements that may affect the economy and price movements. Autochartist Helps you set market-appropriate exit levels by understanding expected volatility, impact of economic events on the market and much more. Trader's Blog Follow our blog to get the latest market updates from professional traders.

Market Heat Map See who are the top daily movers. Movement on the market always attracts interest from the trading community. Market Sentiment Those widgets help you see the correlation between long and short positions held by other traders.

Divergence

Learn the basics or get weekly expert insights. FAQ Get your answers to the frequently asked questions about our services and financial trading.

Trader's Glossary Financial markets have their own lingo.

MACD Indicator Explained | Forex Indicators

Learn the terms, because misunderstanding can cost you money. Held by trading professionals. Risk Management Risk management can prevent large losses in Forex and CFD trading. Learn best-practice risk and trade management, for successful Forex and CFD trades.

Zero to Hero Start your road to improvement today. Our free Zero to Hero program will navigate you through the maze of Forex trading. Forex Have you ever fancied giving trading a go?

Check out our free online Forex education course and learn to trade in just 3 steps! Admiral Club Earn cash rewards on your Forex and CFD trading with Admiral Club points.

Play for fun, learn for real with this trading championship. Personal Offer If you are willing to trade with us, we are willing to make you a competitive offer. About Us About Us Why Us? Find the Truth Behind the Trend with the MT4 Momentum Indicator. Android App MT4 for your Android device. MT4 WebTrader Trade in your browser. MetaTrader 5 The next-gen. MT4 for OS X MetaTrader 4 for your Mac. Forex and CFD trading may result in losses that exceed your deposits.

Please ensure you understand the risks involved. Regulatory Authorisation Contact Us News Testimonials Partnership Careers Press Centre Order execution quality. Products Forex Commodities Indices Shares Bonds Contract Specifications Margin requirements Volatility Protection. Platforms MetaTrader 4 MT4 Supreme Edition MT4 WebTrader MetaTrader 5.

Analytics Fundamental Analysis Technical Analysis Wave Analysis Forex Calendar Autochartist Trader's Blog Market Heat Map Market Sentiment.