Issuing debt to repurchase shares

One advantage for investors and corporations is to be really good at boring stuff. Two things that are boring are capital structure and capital allocation. There are no Apple or Tesla-like events to unveil new strategies for mixing debt and equity, although such an event is funny to imagine.

So are those repurchasing their shares becoming irresponsibly levered to do so? All of what follows is for all U.

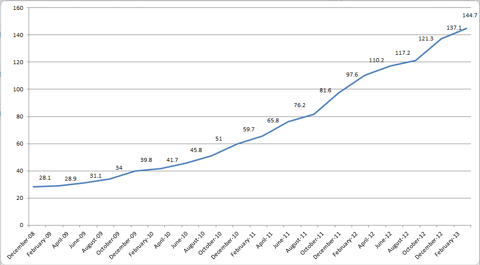

Firms have bought back a lot of stock since the financial crisis. Some companies—most notably Apple—have issued tons of debt and simultaneously bought back stock. This is an easy way for a company to change its capital structure. The number one question I get about the shareholder yield factor is whether or not this debt-funding-buybacks is a big issue and something that should scare us.

Asked differently, are companies that are taking on more debt to buy back shares ticking time bombs? A company gets money from three places: Companies prefer to finance themselves with internally generated cash first, debt second, and precious equity third.

Buybacks and Debt

Here is a comparison of total debt issuance and total equity issuance over the past few decades. You can see that firms vastly prefer to use debt financing, and that there has been a huge surge in debt issued again on a rolling one year basis since the financial crisis.

This rise in rolling debt issuance looks scary, but debt is one thing and interest is another.

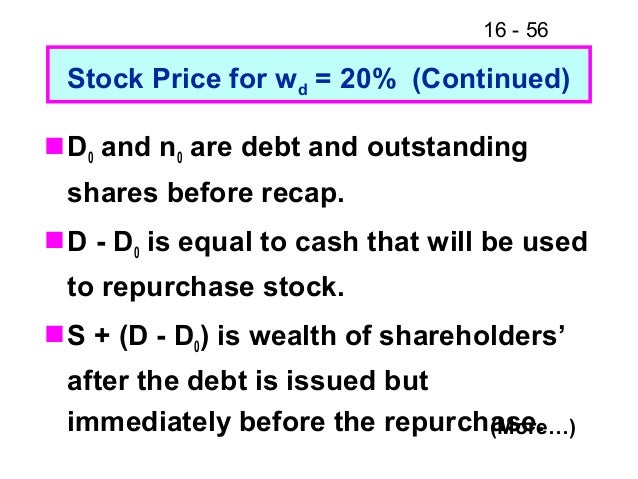

Leveraged Buyback

Rates have fallen while operating earnings have continued to grow. Here is the ratio of operating earnings EBIT to total interest expense for U. Of course, this drop has happened alongside a steady drop in general interest rates.

We can look at debt in a few different ways for these groups. There is some choppiness to these lines because companies can flip back and forth from one group to the other, but the overall trends are clear.

Finally, here is the net debt yield of both groups. This yield is calculated as net new debt issuance minus paydown divided by total debt. The groups look roughly similar. If you buy an index fund, you are levered because companies use leverage.

There is no reason to assume that more debt is a bad thing. Ditto for interest burden: There is way too much nuance within corporate finance to paint the market with a broad brush. Click here to cancel reply.

Sign in to The Investor's Field Guide. We will never post to your profile or share your information.

Stock Repurchase

Every month you'll receive book suggestions--chosen by hand from more than 1, books. You'll also receive an extensive curriculum books, articles, papers, videos in PDF form right away.

Think of this field guide like a book in beta: If you are just stumbling on this site, you can start reading from the beginning. Buybacks and Debt One advantage for investors and corporations is to be really good at boring stuff.

A Story in Charts Firms have bought back a lot of stock since the financial crisis. Many of these are issuing shares. The firms buying back shares are less levered. Posted On October 5, Most Read The Human Blitzkrieg, with Dave Chilton — [Invest Like the Best, EP.

Quant vs Traditional Investors, and How Alphas Become Betas, with Leigh Drogen [Invest Like the Best, EP. The Art of Asset Allocation, with David Salem — [Invest Like the Best, EP.

Understanding Stock Repurchase Plans

Building Something People Want to Buy, with Andy Rachleff [Invest Like the Best, EP. No Responses Click here to cancel reply. Sign in to Respond.

Previous Post To Gain an Edge, Run Up Stairs September 16, Next Post Are You A Paul Revere or William Dawes? Join the Book Club And Receive A Full Investor Curriculum. Sign In Sign in to The Investor's Field Guide. Get a Full Investor Curriculum: Join The Book Club Every month you'll receive book suggestions--chosen by hand from more than 1, books. Welcome to The Investor's Field Guide Millennial Invest has become something new.