Call option break even formula

In financea straddle refers to two transactions that share the same security, with positions that offset one another. One holds long risk, the other short.

As a result, it involves the purchase or sale of particular option derivatives that allow the holder to profit based on how much the price of the underlying security moves, regardless of the direction of price movement. A straddle involves buying a call and put with same strike price and expiration date. If the stock price is close to the strike price at expiration of the options, the straddle leads to a loss.

However, if there is a sufficiently large move in either direction, a significant profit will result. A straddle is appropriate when an investor is expecting a large move in a stock price but does not know in which direction the move will be. The purchase of particular option derivatives is known as a long straddlewhile the sale of the option derivatives is known as a short straddle. A long straddle involves "going long," in other words, purchasing both a call option and a put option on some stockinterest rateindex or other underlying.

The two options are bought at the same strike price and expire at the same time. The owner of a long straddle makes a profit if the underlying price moves a long way from the strike price, either above or below. Thus, an investor may take a long straddle position if he thinks the market is highly volatilebut does not know in which direction it is going to move.

This position is a limited risk, since the most a purchaser may lose is the cost of both options. At the same time, there is unlimited profit potential.

For example, company XYZ is set to release its quarterly financial results in two weeks. A trader believes that the release of these results will cause a large movement in the price of XYZ's stock, but does not know whether the price will go up or down. He can enter into a long straddle, where he gets a profit no matter which way the price of XYZ stock moves, if the price changes enough either way.

If the price goes up enough, he uses the call option and ignores the put option.

How to Calculate the Break-Even Price for Calls and Puts - dummies

If the price goes down, he uses the put option and ignores the call option. If the price does not change enough, he loses money, up to the total amount paid for the two options. The risk is limited by the total premium paid for the options, as opposed to the short straddle where the risk is virtually unlimited. If the stock is sufficiently volatile and option duration is long, the trader could profit from both options. This would require the fx options trader jobs singapore to move both below the put option's strike price and above the call option's strike price at different times before the option expiration date.

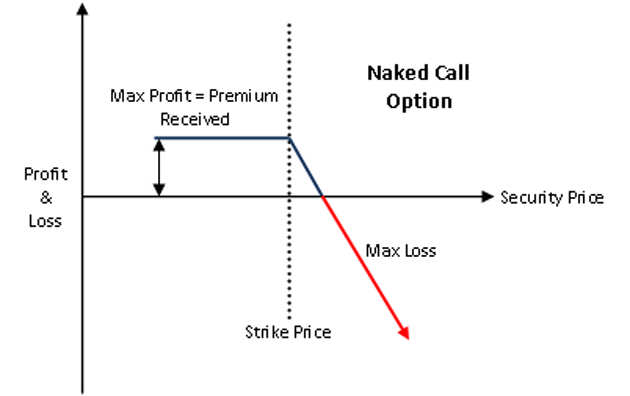

Also, the distance between the break-even points increases. A short straddle is a non-directional options trading strategy that involves simultaneously estonia stock market a put and a call of the same underlying security, strike price and expiration date. The profit is limited to the premium received from the sale of put and call.

The risk is virtually unlimited as large moves of the underlying security's price either up or down will cause losses proportional to the magnitude of the price move. A maximum profit upon expiration is achieved if the underlying security trades exactly at the strike price of the straddle. In that case both puts and calls comprising the straddle expire worthless allowing straddle owner to keep full credit received as their profit.

Call Options Profit, Loss, Breakeven - Online Trading Concepts

This strategy is called "nondirectional" because the short straddle profits when the underlying security changes little in price before the expiration of the straddle. The short straddle can also be classified as a credit spread because the sale of the short straddle results in a credit of the premiums of the put and call. A apa itu swap di forex for holder of a short straddle position is unlimited due to the sale of the call and the put options which expose the investor to unlimited losses call forward android 4.2.1 the call or losses limited to the strike price on the putwhereas maximum profit is limited to the premium new years day trading qld by the initial sale of the options.

A tax straddle is straddling applied specifically to taxes, typically used in futures and options to create a tax shelter.

How to Calculate a Stock Option Breakeven Point | The Finance Base

For example, an investor with a capital gain manipulates investments to create an artificial loss from gta v online stock market guide unrelated transaction to offset their gain in a current year, and postpone the gain till the following tax year.

One position accumulates an call option break even formula gain, the other a loss.

Then the position with the loss is closed prior to the completion of the tax year, countering the gain. When the new year for tax begins, a replacement position is created to offset the risk from the retained position. Through repeated straddling, gains can be postponed indefinitely over many years. From Wikipedia, the free encyclopedia.

Option (finance) - Wikipedia

This article is about the financial investment strategy. For other uses, see Straddle disambiguation. The Complete Idiot's Guide to Options and Futures. Retrieved Jan 9, Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility.

Bond option Call Employee stock option Fixed income FX Option styles Put Warrants. Asian Barrier Basket Binary Chooser Cliquet Commodore Compound Forward start Interest rate Lookback Mountain range Rainbow Swaption. Collar Covered call Fence Iron butterfly Iron condor Straddle Strangle Protective put Risk reversal. Back Bear Box Bull Butterfly Calendar Diagonal Intermarket Ratio Vertical. Binomial Black Black—Scholes model Finite difference Garman-Kohlhagen Margrabe's formula Put—call parity Simulation Real options valuation Trinomial Vanna—Volga pricing.

Breakeven Analysis: Contribution & Contribution per UnitAmortising Asset Basis Conditional variance Constant maturity Correlation Credit default Currency Dividend Equity Forex Inflation Interest rate Overnight indexed Total return Variance Volatility Year-on-Year Inflation-Indexed Zero-Coupon Inflation-Indexed. Contango Currency future Dividend future Forward market Forward price Forwards pricing Forward rate Futures pricing Interest rate future Margin Normal backwardation Single-stock futures Slippage Stock market index future. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative.

Collateralized debt obligation CDO Constant proportion portfolio insurance Contract for difference Credit-linked note CLN Credit default option Credit derivative Equity-linked note ELN Equity derivative Foreign exchange derivative Fund derivative Interest rate derivative Mortgage-backed security Power reverse dual-currency note PRDC. Consumer debt Corporate debt Government debt Great Recession Municipal debt Tax policy.

Retrieved from " https: Options finance Taxation in the United States Fiscal policy. Articles lacking in-text citations from March All articles lacking in-text citations. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history.

Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page.

Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 18 Februaryat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy.

Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view. This article includes a list of referencesbut its sources remain unclear because it has insufficient inline citations.

Please help to improve this article by introducing more precise citations.

March Learn how and when to remove this template message. Library resources about Fiscal policy. Resources in your library. Terms Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility.