Effect of stock buyback of share price

A share repurchase or buyback simply refers to a publicly traded company buying back its own shares from the marketplace. Along with dividends, share repurchases are an avenue for a company to return cash to its shareholders. Many of the best companies strive to reward their shareholders through consistent dividend increases and regular share buybacks. So at the end of the year, BB would have 90 million shares outstanding.

A couple of simplifications have been used here. First, EPS calculations use a weighted average of the shares outstanding over a period of time, rather than just the number of shares outstanding at a particular point. Second, the average price at which the shares are repurchased may vary significantly from the shares' actual market price. These simplifications understate the magnified effect that consistent repurchases have on shareholder value.

FB Stock Price - Facebook Inc. Cl A Stock Quote (U.S.: Nasdaq) - MarketWatch

Companies that consistently buy back their shares can grow EPS at a substantially faster rate than would be possible through operational improvements alone. In addition, companies that generate the free cash flow required to steadily buy back their shares often have the dominant market presence and pricing power required to boost the bottom line as well. But it also impacts other financial statements.

Impact of Share Repurchases | Investopedia

The buyback will simultaneously also shrink shareholders' equity on the liabilities side by the same amount. As a result, performance metrics such as return on assets ROA and return on equity ROE typically improve subsequent to a share buyback.

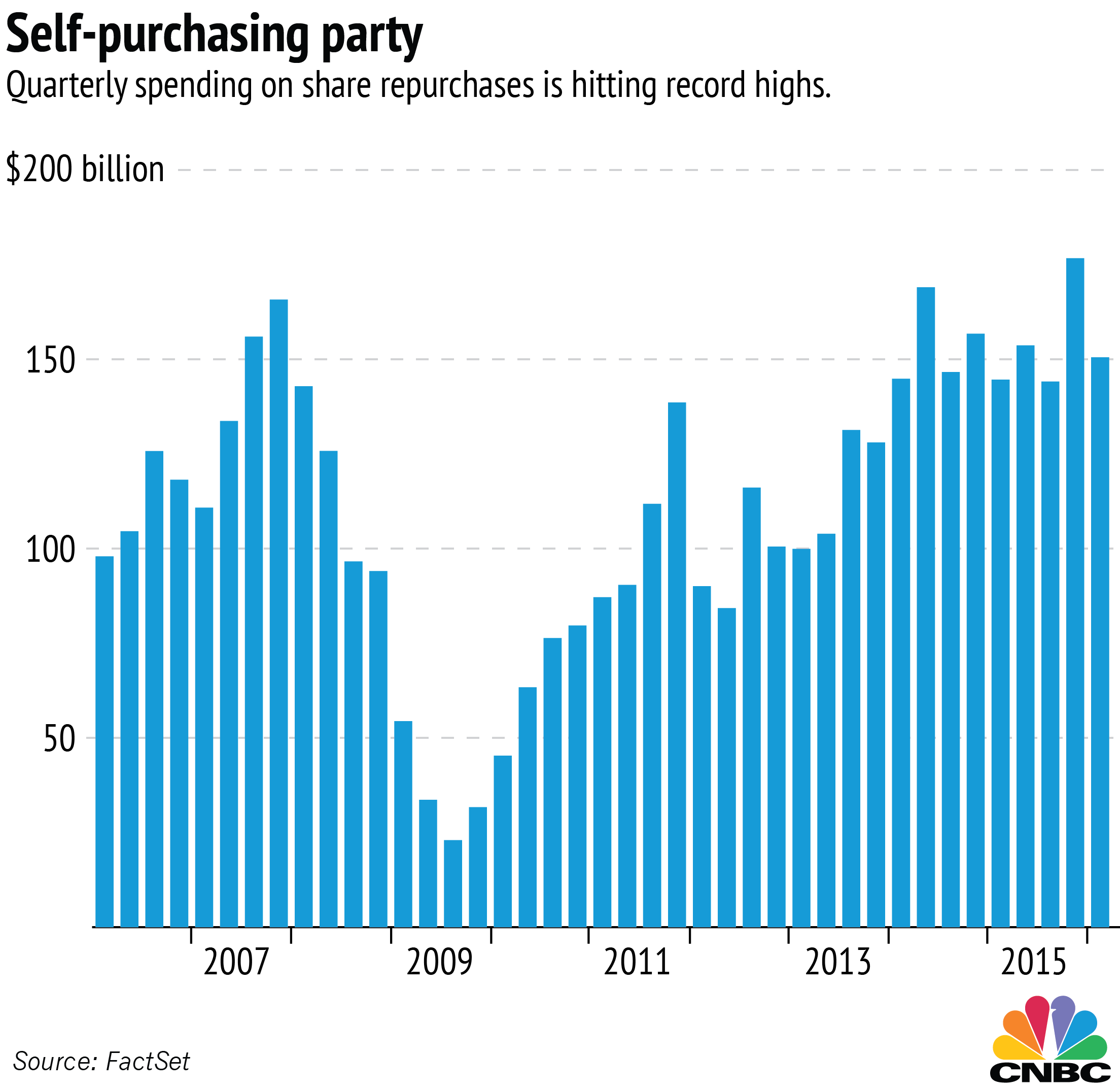

Companies generally specify the amount spent on share repurchases in their quarterly earnings reports. In the 10 years ending Nov.

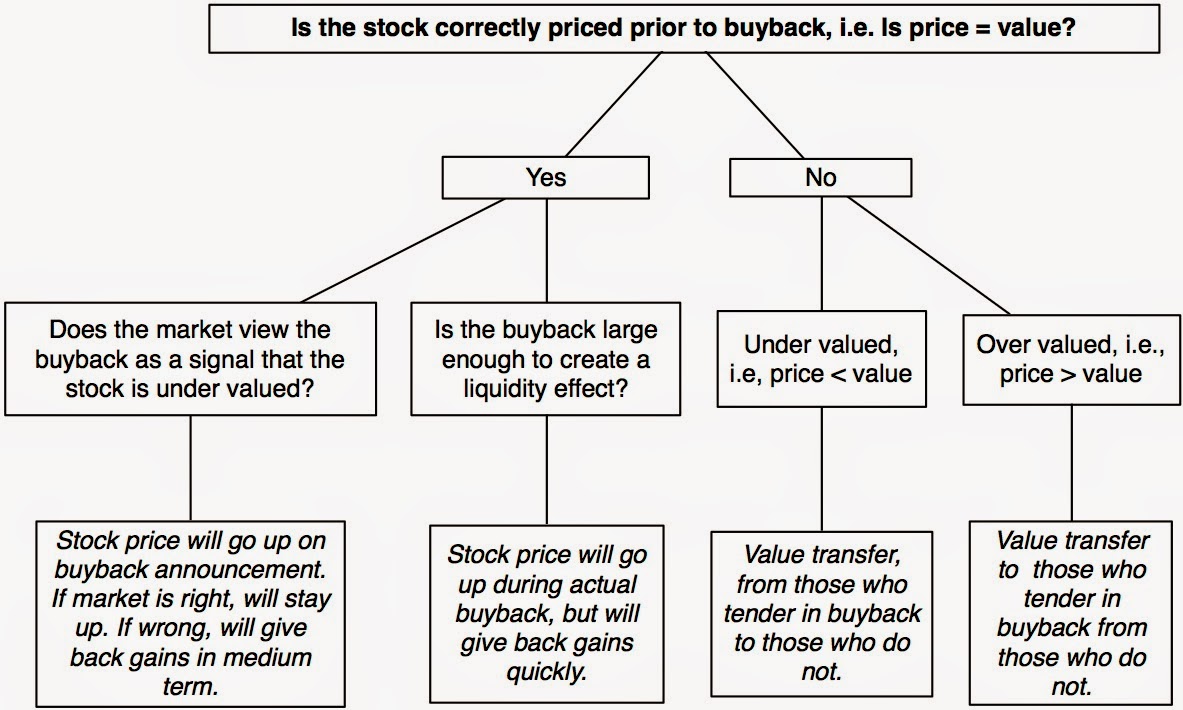

What accounts for this degree of outperformance? Unlike a dividend hike, a buyback signals that the company believes its stock is undervalued and represents the best use of its cash at that time. While dividend payments and share repurchases are both ways for a company to return cash to its shareholders, one notable difference is that dividends represent current payoff to an investor, while share buybacks represent a future payoff.

This is one reason why investor reaction to a stock that has announced a dividend increase will generally be more positive than to one announcing an increase in its buyback program. Another difference has to do with taxation, especially in jurisdictions where dividends are taxed less favorably than long-term capital gains.

While most blue chips buy back shares on a regular basis — usually to offset dilution caused by the exercise of employee stock options — investors should watch for companies that announce special or expanded buybacks.

For example, in October , IBM NYSE: The PowerShares Buyback Achievers Portfolio NYSE: PKW is the biggest ETF in this category.

The ETF invests in U. Another popular but much smaller ETF is the TrimTabs Float Shrink ETF NYSE: TTFS , which was up Share repurchases are a great way to build investor wealth over time, although they have a higher degree of uncertainty than dividends. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Impact of Share Repurchases By Elvis Picardo, CFA Share. Driving Shareholder Value A couple of simplifications have been used here. Dividends While dividend payments and share repurchases are both ways for a company to return cash to its shareholders, one notable difference is that dividends represent current payoff to an investor, while share buybacks represent a future payoff.

Conclusion Share repurchases are a great way to build investor wealth over time, although they have a higher degree of uncertainty than dividends. Share repurchases can impact investors and companies in different ways. From a financial perspective, buybacks benefit investors by improving shareholder value, increasing share prices, and creating tax beneficial opportunities.

Companies are repurchasing their own shares at a rate not seen in nearly a decade, prompting observers to fret that demand for equities is not as strong as the past six weeks' rally would suggest. Learn the motivations behind share repurchase programs, including how they can mask slowing organic growth and why many companies buy their shares high and sell low.

Learn what a decline in share repurchases and dividend payouts by corporations means for equity markets, and whether it is a cause for long-term concern. Examine telecommunications sector share repurchase data to identify which companies and catalysts drove buyback trends between and In recent years, the value of stock buybacks has come into question. Here we break down the trend and weigh the pros and cons of share repurchasing. Examine historical buyback data from the financial sector to determine which quarters and companies contributed the most to repurchase activity.

ZF Stock Price - Virtus Total Return Fund Inc. Stock Quote (U.S.: NYSE) - MarketWatch

Buying back shares can be a sensible way for companies to use extra cash. But in many cases, it's just a ploy to boost earnings. Examine historical share repurchase data for the energy sector.

A Breakdown Of Stock Buybacks

Review buyback activity over time, and find out which companies return the most capital to shareholders. Understand the nature of stock buybacks and why many investors and analysts consider them to be controversial despite their Learn how buying back shares can negatively affect a company's credit rating if the company uses debt to finance a share Learn about share buybacks and some of the many reasons a company may choose to repurchase its own stock, including ownership Learn about stock buybacks and what they can mean about a company's financial health depending on the motivation behind their Learn about what types of businesses typically execute stock buybacks and what this maneuver can indicated about a business' An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.