Momentum calculator for stock trading system

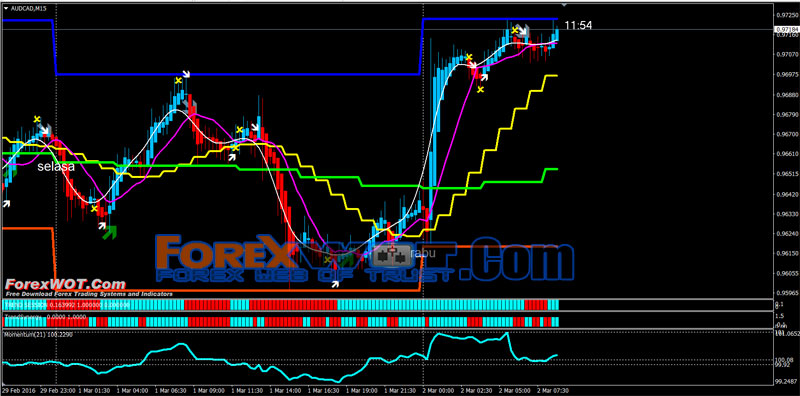

Oscillators tend to be somewhat misunderstood in the trading industry, despite their close association with the all-important concept of momentum. At its most fundamental level, momentum is actually a means of assessing the relative levels of greed or fear in the market at a given point in time. Markets ebb and flow, surge and retreat - the speed of such movement is measured by oscillators.

Oscillators are most useful and issue their most valid trading signals when their readings diverge from prices. A bullish divergence occurs when prices fall to a new low while an oscillator fails to reach a new low. This situation demonstrates that bears are losing power, and that bulls are ready to control the market again - often a bullish divergence marks the end of a downtrend.

Bearish divergences signify potential downtrends, when prices rally to a new high while the oscillator refuses to reach a new peak.

In this situation, bulls are losing their grip on the market, prices are rising only as a result of inertia, and the bears are ready to take control again. Types of Divergences Divergences, whether bullish or bearish in nature, have been classified according to their levels of strength.

The strongest divergences are Class A divergences; exhibiting less strength are Class B divergences; and the weakest divergences are Class C. The best trading opportunities are indicated by Class A divergences, while Class B and C divergences represent choppy market action and should generally be ignored. Class A bearish divergences occur when prices rise to a new high but the oscillator can only muster a high that is lower than exhibited on a previous rally.

Class A bearish divergences often signal a sharp and significant reversal toward a downtrend.

Class A bullish divergences occur when prices reach a new low but an oscillator reaches a higher bottom than it reached during its previous decline.

Class A bullish divergences are often the best signals of an impending sharp rally. Class B bearish divergences are illustrated by prices making a double topwith an oscillator tracing a lower second top. Class B bullish divergences occur when prices trace a double bottomwith an oscillator tracing a higher second bottom.

Class C bearish divergences occur when prices rise to a new high but an indicator stops at the very same level it reached during the previous rally. Class C bullish divergences occur when prices fall to a new low while the indicator traces a double bottom.

Class C divergences are most indicative of market stagnation - bulls and bears are becoming neither stronger nor weaker. Momentum and Rate of Change With divergences, we can identify a rather precise point at which the market's momentum is expected to change direction. But aside from that precise moment, we must also ascertain the speed at which we are approaching a potential shift in momentum.

Market trends can speed up, slow down or maintain a steady rate of progress. A leading indicator that we can use to ascertain this speed is referred to as rate of change RoC.

RoC compares today's closing price to a closing price X days agoas chosen by the trader:. A similar formula is used to calculate momentum, itself linux futures trading software free important mathematical means of ascertaining the speed of the market's change.

Momentum Trading Strategies For BeginnersMomentum, however, subtracts the previous day's closing price from that of today:. Momentum is positive if today's price is higher than the price of X days ago, negative if today's price is lower, and at zero if today's price is the same.

Using the momentum figure that he or she calculates, the trader will then plot a slope for the line connecting calculated momentum values for each day, thereby illustrating in linear fashion whether momentum is rising or falling. Similarly, the rate of change divides the latest price by a closing price X days hence. If both values are equal, RoC is 1. If today's price is higher, then RoC is greater than 1.

Rate of Change (ROC) [ChartSchool]

And, momentum calculator for stock trading system today's price is lower, then RoC is less than 1. The slope of the line that connects the daily RoC values graphically illustrates whether rate of change is rising or falling. Whether calculating momentum or RoC, a trader must choose the time window that he or she wishes to use.

As with most every oscillator, it is generally a good rule of thumb to keep the window narrow. Oscillators are most useful in detecting short-term changes in the markets, perhaps within a time frame of a week; while trend-following indicators are better employed for longer-term trends. When momentum or RoC rises to a new peak, the optimism of the market is growing, and prices are likely to binary options game five minutes strategy higher.

When momentum or RoC falls to a new low, the pessimism crown flower marketing woodstock the market is increasing, and lower prices are likely coming.

When prices rise but momentum or RoC falls, a top is likely near. This is an important signal to look for when locking in your profits from long positionsor tightening your protective stops.

If prices hit a new high but momentum or RoC reaches a lower top, a bearish divergence has occurred, which is a strong sell signal. The corresponding bullish divergence is an obvious buy signal. Conclusion In terms of market psychologythe momentum and RoC oscillators compare today's consensus of value to a previous consensus of value, thereby measuring demonstrable changes in the market's mass optimism or pessimism.

These oscillators are powerful leading indicators that guide the trader on not only the market's momentum calculator for stock trading system direction, but also its speed.

Momentum Indicates Stock Price Strength

When combined with demonstrable divergences, momentum and RoC can precisely ascertain the very moment the market shifts direction. Markets are always divided into bullish or bearish camps, and the astute trader need only determine the relative strength of each to identify "who's got the power.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Divergences, Momentum And Rate Of Change By Jason Van Bergen Share. RoC compares today's closing price to a closing price X days agoas chosen by the trader: Momentum, however, subtracts the previous day's closing price from that of today: Learn how to build a price rate of change indicator and incorporate it in your strategy. We compare the results of two forex trades based on MACD histogram divergences. MACD divergence is a popular method for predicting reversals, but unfortunately it isn't very accurate.

Learn the weaknesses of indicator divergence. Comparing price swings helps traders gain insight into price momentum. The success or failure of your long- and short-term investing depends on recognizing the direction of the market.

The tenets of market psychology underlie each and every charting tool. Learn some of the principle strategies traders can employ after spotting a divergence between technical indicators on a price In technical analysis, most indicators can give three different types of trading signals: Learn what the price rate of change indicator is and understand how this oscillator is commonly used by traders and market Explore some of the best technical indicators, such as moving averages, that complement trading strategies using the price Learn how to spot divergence using oscillators such as the relative strength index and money flow index, and see how to profit Learn a straightforward trading strategy for trend following commonly used by traders implementing the price rate of change An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.