History of commodity exchange in india

Modern commodities trading typically refers to trading futures contracts, derivatives, and other financial products. In ancient history, however, commodities trading was as simple as trading wheat for copper yes, just like in Settlers of Cataan.

Commodity trading in India - Wikipedia

Where did it come from and where did it originate? In Sumer which is in modern day Iraq , citizens would use clay tokens sealed in a clay vessel as an medium of exchange for goats.

Clay writing tablets indicated the number of clay tokens inside each sealed vessel, and the merchant would deliver the specified number of goats Source. The fact that the clay tablets included the amount, time, and date tells us that they were the earliest form of commodity futures contracts. Over the centuries, traders continuously improved on that system, eventually leading to gold and silver trading markets in classical civilizations.

Throughout history, there have been four main categories of commodities trading, including all of the following:. As commodity markets have expanded, the need for other commodities and futures categories has emerged. Goats and pigs might have been the earliest commodities traded, but by the time classical civilizations arose, people were using gold and silver as a medium of exchange.

Today, we take it for granted that gold and silver hold value. In the early days of civilization, for example, gold and silver were valued for their beauty.

This quality attracted the attention of royalty, and soon enough, gold and silver were associated with royalty and had intrinsic worth. As the centuries passed, gold and silver naturally evolved into a medium of exchange on their own. A specific amount of gold would be measured out, and gold became an early form of money.

Gold could easily be melted, shaped, and measured. It was also scarce throughout most of the world. These qualities made it a natural trading asset. Commodity markets grew throughout medieval Europe. At the time, they were the best way to distribute goods, labor, land, and capital across the region. Merchants would accept gold in exchange for goods.

They could then use this gold throughout most of the world. As time passed, regions began to make their own forms of coinage. By the late medieval times, reliable scales had been invented that allowed villagers to easily weight different forms of coinage. Instead of traveling to urban centers like Amsterdam to weigh coins or goods, villagers could travel locally.

However, before it was a stock exchange, it operated as a market for the exchange of commodities.

Traders on the Amsterdam Stock Exchange participated in the purchase and sale of sophisticated financial products at least, they were sophisticated for the time , including short sales, forward contracts, and options. Over the s and s, a growing number of cities would add their own commodity exchanges where they sold similar products. America got into the commodities trading action in with the invention of the Chicago Board of Trade CBOT.

That exchange used wheat, corn, cattle, and pigs as standard instruments. The CBOT would expand its commodity trading in the s through the Commodity Exchange Act. The Act added new items to the list, including rice, mill feeds, butter, eggs, soybeans, and potatoes. What kind of measurements does a cow need to have in order to be considered a cow? Successful commodity markets required a broad consensus on product variations. Even classical civilizations struggled with definitions.

Many of these civilizations later set rules governing trading gold or silver for spices, cloth, wood, weapons, and other goods.

Starting in , the US government decided to create something called the Commodity Price Index. The Commodity Price Index would eventually become available to the public in It consisted of a computation of the 22 commodity prices listed above.

Most countries around the world today have their own version of the commodity price index. Today, the American Bureau of Labor Statistics produces the commodity price index, which is actually classed as part of the Producer Price Index PPI report.

You can view all of the reports here. The downloadable reports go into specific detail about commodity prices.

You can view price indexes for specific items like table grapes, wine grapes, and juice grapes, for example each of which is measured differently all the way down to slaughter chickens, slaughter turkeys, and slaughter ducks. There are over items mentioned on the commodities list in total. Starting in the s, a new commodity-based financial product called a Commodity Index Fund became available. A commodity index fund is a fund where the assets are invested into financial instruments based on — or linked to — a commodity index.

The Chase Physical Commodity Index is one such fund. Today, commodity prices vary widely. As you can imagine, certain commodities are more vulnerable to fluctuations than others. Agricultural commodities, for example, can be volatile during the summer months depending on weather events.

Commodity prices can be affected by unusual weather, natural disasters, epidemics, man-made events, and countless other circumstances. The unpredictability — and lack of control — of these events is why many people feel commodities markets are unpredictable. One of the common traits across commodities markets is the use of futures, forward contracts, and hedging, all of which are popular among commodities exchanges. A forward contract, or future, lets you avoid market volatility by selling future commodities at a fixed price today.

By locking into one price today, you avoid the risk associated with commodities markets. The airline industry is an active player in the commodity futures market.

This allows them to avoid the market volatility associated with crude and gasoline. On the one hand, airlines lose money if oil goes down within the next year.

But on the other hand, they save money if oil goes up in the price. Up above, we talked about how commodities are typically separated into categories like energy, precious metals, livestock, and agriculture.

Modern commodity exchanges, however, require a few additional categories. Here are the common commodities and futures used today specifically in the United States:.

Chicago, as the hub of transportation and agriculture in the Midwest, was a natural place for commodity exchanges to emerge in America. However, over the 20th century, commodity exchanges emerged all across America, including in Minneapolis, Milwaukee, St.

Louis, Kansas City, and other Midwest cities. Commodity markets also opened in New York, New Orleans, Memphis, San Francisco, and others. Nevertheless, Chicago continued to be the hub of commodities future trading throughout America.

How has commodity futures trading changed in the 21st century with the invention of the internet? The addition of online trading systems has led to a heightened interest in commodities and futures — although the same can be said with virtually every other asset. Today, traders make entire careers out of futures trading, and commodities and futures markets have expanded to address this growth. Futures markets can be found all over the world, with different futures markets specializing in different goods.

There are also niche futures and commodities markets, like the Minneapolis Grain Exchange MGEX , which was launched all the way back in by the Minneapolis Chamber of Commerce. To this day, the MGEX is the only place where you can exchange futures contracts on hard red spring wheat. It remains a popular grain futures clearinghouse to this day and averages about one million contract trades a year.

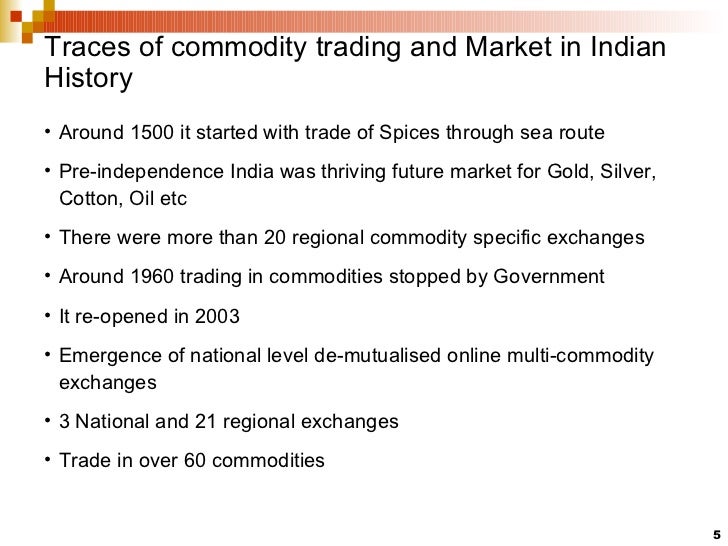

As the developing world continues to grow, commodity futures markets are inevitably appearing throughout these countries. Starting in , India has had its own commodity futures exchange, for example, consisting of three nationwide multi-commodity indexes, including:. In early history, commodities and futures trading primarily involved farmers and merchants.

Today, commodities and futures markets are complex exchanges found across the world — including everywhere from the Chicago Board of Trade to the Tokyo Commodities Exchange. Thanks to commodities trading, companies in commodity-heavy industries like the airline industry are able to hedge their bets against unexpected events.

Instead of being subject to the changing price of oil, for example, airlines can remain stable throughout the years. For these reasons — and countless others — commodities and futures markets play a crucial role in the global economy. Your email address will not be published. Friday , 26 May About Contact Methodology How-to Contact Congress!

Menu Item Resource Guides History Tutorials Guide To Google Adsense How To Register a Domain How To Make A Blog Basic HTML Tutorial Reviews Money Diamonds How Much To Spend On Engagement Ring How To Buy Engagement Ring Online How To Finance Engagement Ring How To Pick A Diamond Online Linkedin Linkedin Professional Summary Examples Impressive Statistics of LinkedIn Linkedin Profile Writing Service Top 15 LinkedIn Marketing Tips Linkedin How-to How To Use linkedin How to Create an Amazing LinkedIn Company Profile How to Create a LinkedIn Company Page for your Business How to Create a Powerful LinkedIn Network How to Use LinkedIn for Your Small Business How to Set Up a Company on LinkedIn Online Fax Fax From Computer Faxing To Email Send a Fax Online Getting a Fax Number Where Can I Fax Something Near Me?

History of Commodities Trading: From the Beginning to Current Commodities Trading

Fax Internationally Online Payroll Free Payroll Software Buy Payroll Software Payroll Tax Guide Certified Payroll Software How-to Do Payroll VoIP Web Tutorials Free Resume Samples. History of Commodities Trading Commodities trading is as old as civilization itself. Four Categories of Commodities Trading Throughout history, there have been four main categories of commodities trading, including all of the following: Energy Commodities Like crude oil, natural gas, and gasoline Metal Commodities Like gold, silver, and platinum Livestock and Meat Commodities Like pork bellies, live cattle, and feeder cattle Agricultural Commodities Like corn, soybeans, wheat, rice, cocoa, coffee, cotton, and sugar As commodity markets have expanded, the need for other commodities and futures categories has emerged.

Gold and Silver Trading as a Commodity Goats and pigs might have been the earliest commodities traded, but by the time classical civilizations arose, people were using gold and silver as a medium of exchange. Gold was one of the first forms of commodity trading in history.

Commodity Markets in Medieval Europe Commodity markets grew throughout medieval Europe. By the s, stock exchanges started to emerge — including the Amsterdam Stock Exchange. The Commodity Price Index of Starting in , the US government decided to create something called the Commodity Price Index.

Commodity Index Funds Starting in the s, a new commodity-based financial product called a Commodity Index Fund became available. What Affects Commodity Prices? The Unpredictability of Commodity Markets Leads to Futures Markets One of the common traits across commodities markets is the use of futures, forward contracts, and hedging, all of which are popular among commodities exchanges.

Modern Commodity and Future Categories Up above, we talked about how commodities are typically separated into categories like energy, precious metals, livestock, and agriculture. Here are the common commodities and futures used today specifically in the United States: Corn, oats, soybeans, rice, soybean meal, soybean oil, wheat, orange juice Livestock: Hogs, frozen pork bellies, live cattle, feeder cattle Energy: Crude oil, heating oil, ethanol, natural gas, gasoline, propane, uranium, electricity Precious Metals: Gold, platinum, palladium, silver Industrial Metals: Aluminum, steel, copper Financial Equities: US Treasury Bond futures, US Treasury bill futures, indexes, currencies Soft Commodities: Sugar, cocoa, coffee, cotton Pulp: Lumber Commodity Exchanges Opened Across America During the 20th Century Chicago, as the hub of transportation and agriculture in the Midwest, was a natural place for commodity exchanges to emerge in America.

Commodity Trading and the Internet How has commodity futures trading changed in the 21st century with the invention of the internet? Types of Futures and Commodities Markets Available Today Chicago Mercantile Exchange CME: Energy, precious metals, industrial metals, livestock, and financials Chicago Board of Trade CBOT: Agriculture and livestock New York Mercantile Exchange NYMEX: Energy and precious metals New York Board of Trade NYBOY: Agriculture and financials London Metal Exchange LME: Industrial metals Australian Stock Exchange ASE: Energy, environmental, financial, agriculture NYSE Euronext ASE: Energy, environmental, financial, and agriculture based in France Tokyo Commodities Exchange TOCOM: Energy, precious metals, industrials metals, and rubber Korea Exchange KRS: Financials and precious metals There are also niche futures and commodities markets, like the Minneapolis Grain Exchange MGEX , which was launched all the way back in by the Minneapolis Chamber of Commerce.

Commodity Futures Exchanges in Third World Countries As the developing world continues to grow, commodity futures markets are inevitably appearing throughout these countries. Starting in , India has had its own commodity futures exchange, for example, consisting of three nationwide multi-commodity indexes, including: What Does the Future Hold for Commodities Trading?

After having graduated with a degree in Finance and working for a Fortune company for several years, Johnson decided to follow his passion by embarking on a path to the digital world. He has over 8 years of experience with large companies setting marketing strategy and he likes to workout in his spare time.

Leave a Reply Cancel reply Your email address will not be published. Our goal with any review is to combine objective data with subjective opinions.

In short, we want to give you the edge you need to be successful.

How-to Fax From Computer. Fitness on a Budget. SBA Biz Stats SCORE Business Plan American Fact Finder EconData Valuation Resources Push Profile. Private Policy Contact About.